The IRS announced on January 23, 2014 that Cash Balance defined benefit plans will eventually be able to utilize pre-approved master and prototype plan documents. Currently, all Cash Balance plans must be written as individually-designed documents. The IRS announcement extends to February 2, 2015 the deadline for plan document drafters to submit their new traditional defined benefit master and prototype plan documents for IRS approval. By extending that deadline from January 31, 2014, the IRS stated it will now have time to publish guidance on Cash Balance plan language that will eventually be acceptable under the IRS’s master and prototype program.

Nathan Carlson

Recent Posts

Important Development for Cash Balance Plans—But You Must Act Quickly!

Posted by Nathan Carlson on Wednesday, January 29, 2014 @ 02:49 PM

Tags: Pension

401(k) Auto-Enrollment Becoming the Norm

Posted by Nathan Carlson on Wednesday, January 15, 2014 @ 03:27 PM

Do 401(k) plans positively impact employee retirement savings? Let the statistics speak for

themselves.

“According to the Employee Benefit Research Institute (EBRI), more than 70% of employees earning between $30,000 and $50,000 participate in a 401(k) plan when it is offered to them at work, while fewer than 5% of those same employees save on their own in an IRA when they are

not covered by a workplace retirement savings plan.”i Such a startling difference in outcomes is attributed to the convenience of payroll deduction of a 401(k) plan, the culture of savings that such a plan creates, and, frankly, the inertia of employees—once enrolled they tend to stay enrolled in the 401(k) plan.

Tags: 401(k), Benefits Information

ERISA Dates You Really Don't Want to Miss!

Posted by Nathan Carlson on Wednesday, January 08, 2014 @ 02:02 PM

Tags: ERISA, 2014 ERISA Dates

Solo-Ks: 5 Benefits and 5 Mistakes to Avoid

Posted by Nathan Carlson on Friday, December 20, 2013 @ 02:13 PM

A 401(k) plan established for just the business owner, or the business owner and spouse, has become a popular retirement plan and for many has replaced the SEP (Simplified Employee Pension plan) as the retirement plan of choice. This form of a 401(k) plan is often referred to as a “Solo‐K”.

The Solo‐K is preferred over a SEP for several reasons. First, in some situations it provides a greater tax deduction than a SEP. The deduction to the Solo‐K is limited to 25% of earned income plus any 401(k) deferrals (see #1 below) whereas the deduction to the SEP is capped at 25% of earned income (see #2 below). Second, a Solo‐K can include a participant loan feature whereas the SEP cannot. Third, the annual benefit limit (referred to as the Section 415 limit) is expanded by any 401(k) catch‐up contributions. Fourth, the Solo‐K can allow for ROTH 401(k) contributions, regardless of one’s income level, whereas the SEP cannot. Fifth, the Solo‐K can exclude employees who work less than 1,000 hours per year whereas the SEP cannot.

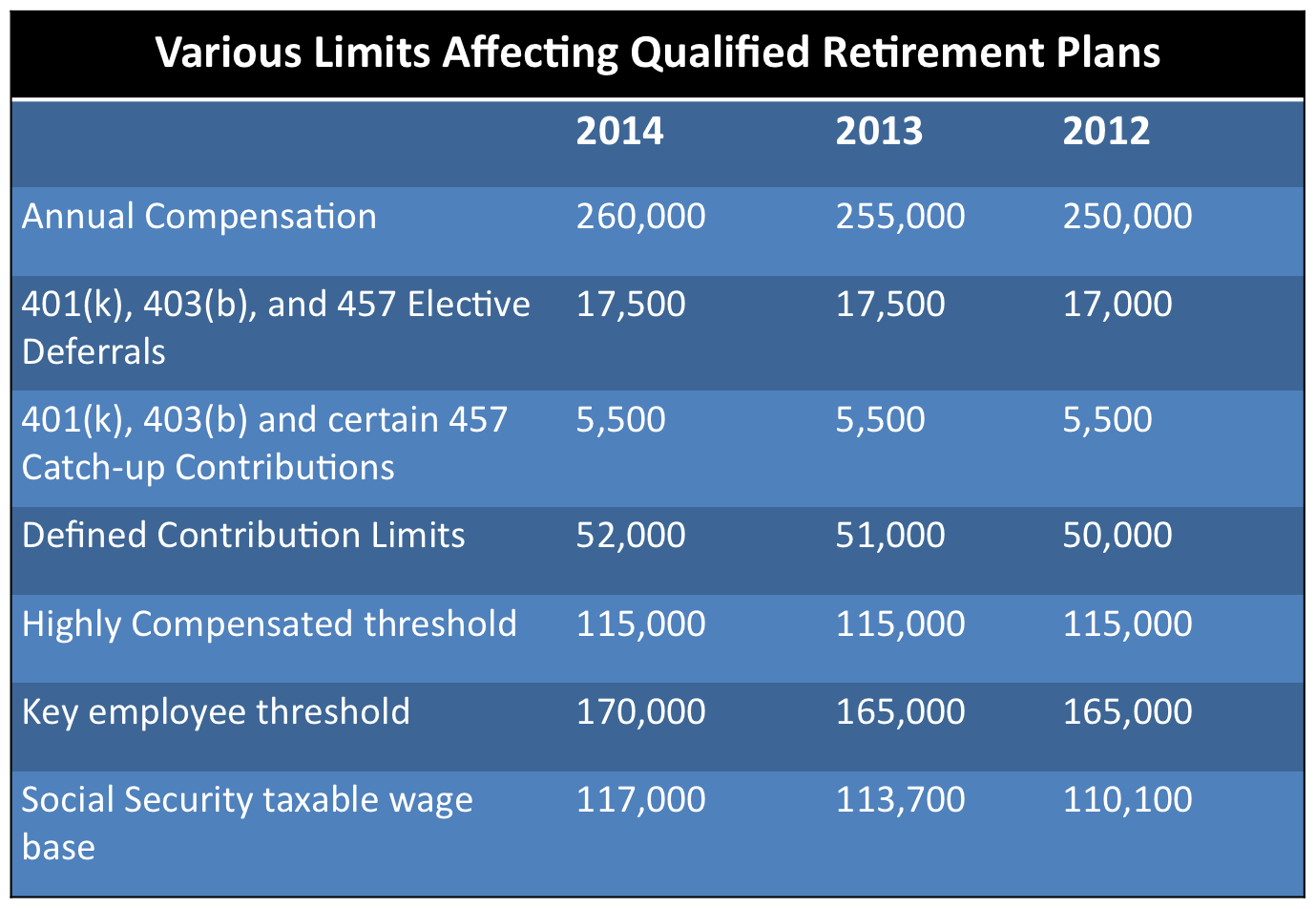

Example: A corporate business owner, age 50, earning $138,000/year could contribute $34,500 to a SEP (25% of $138,000). That same business owner could contribute in 2014 $57,500 to a Solo‐K [($138,000 x 25%) + $17,500 401(k) deferral + $5,500 401(k) catch‐up contribution]. The employee deferrals of $23,000 ($17,500 + $5,500) made to the Solo‐K can be after‐tax, ROTH contributions, if so elected and permitted by the plan document, regardless of the owner’s income (see #3 below).

Despite their popularity, businesses that adopt a Solo‐K need to avoid 5 key mistakes.

1. Employees improperly excluded from the plan. The Solo‐K must allow any employees within the “controlled group” to participate once the employees have met the plan’s eligibility provisions.

a. Example: Dave owns ABC Company that has only two employees, Dave and his wife, Sue. However, Sue owns a consulting firm, XYZ Company that has 5 employees. If Dave establishes a 401(k) for ABC Company, the plan must also include the employees of XYZ Company since the two entities comprise a “controlled group” through family attribution. In other words, Dave can not establish a ‘Solo‐K” for just him and his wife; the plan must cover all employees within the “controlled group”.

2. Failing to file Form 5500. Solo‐Ks that cover only the owner and his or her spouse are not covered by Title 1 of ERISA and are not required to file Form 5500 so long as the plan’s assets are under $250,000. However, an annual Form 5500 must be filed for any plan year where the assets exceed $250,000 or the plan covers someone other than the owner and spouse.

a. Example. John and his wife Sarah own a real estate company and sponsor a Solo‐K. Since the Solo‐K has assets in it totaling only $100,000, John has not been filing Form 5500. However, during the summer of 2013 John decides to employ his son, John Jr., to help with some mailings. If the eligibility requirements found in John’s Solo‐K Plan Document allow for immediate entry into the plan, (as most do) John Jr. will become eligible for the Solo‐K upon his date of hire. If so, starting with the 2013 plan year, it must file Form 5500 regardless of the amount of assets in the plan since the Solo‐K covers someone other than an owner and the owner’s spouse.

i. Solution: The eligibility provisions in a Solo‐K Plan Document can delay an employee’s entry into the plan until the January 1 or July 1 following the later of 1 year of service (see #4 below) or the attainment of age 21. Having such an eligibility provision is recommended since it may keep some part‐time employees from entering the Solo‐K and delay the entry date of others.

Solo‐Ks can provide great tax breaks and well‐needed retirement savings; however, care must be taken so that the plan stays in compliance with the web of complex tax laws.

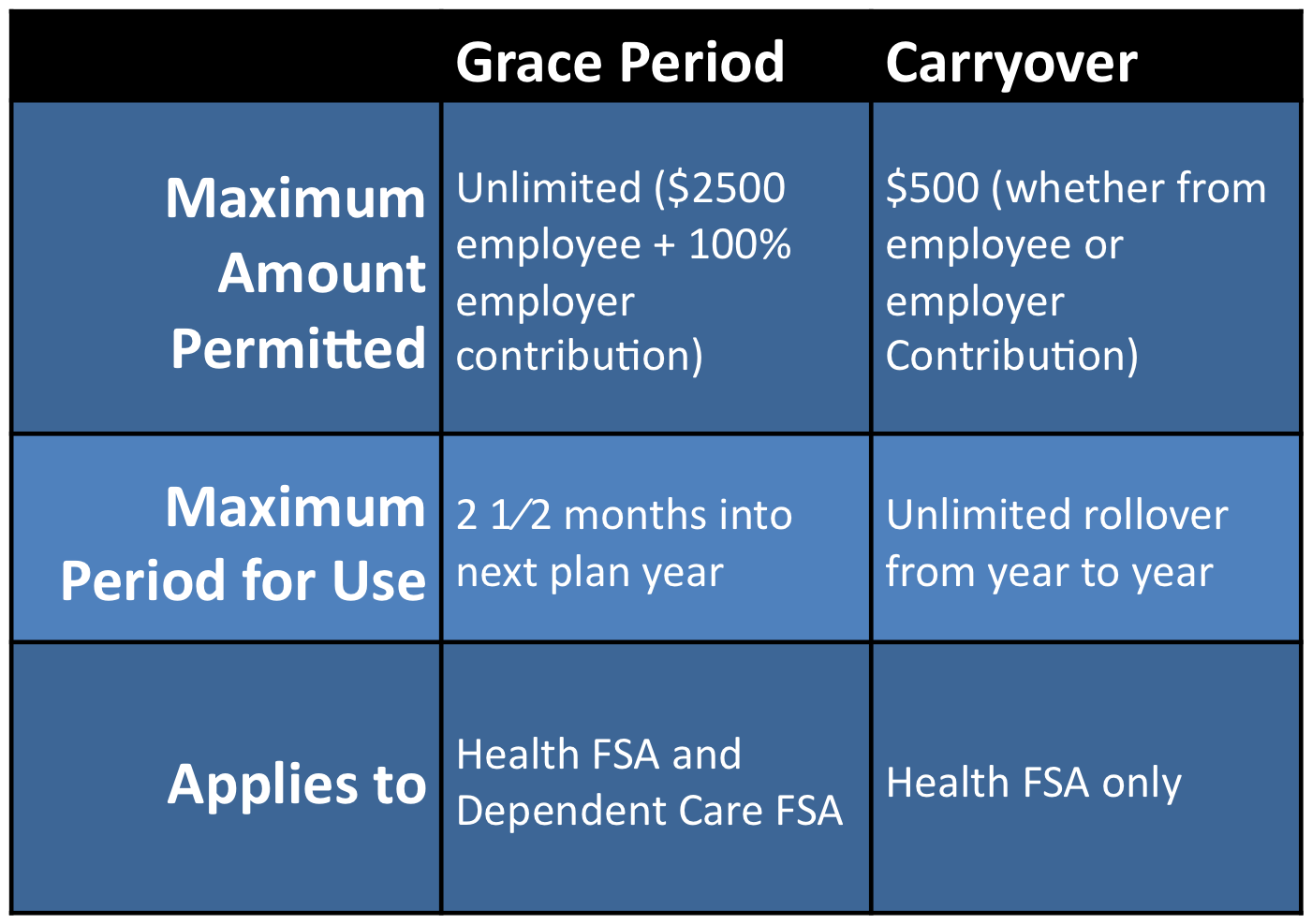

IRS Announces $500 Carry‐Over Provision for Health FSA Plans!

Posted by Nathan Carlson on Friday, November 01, 2013 @ 03:03 PM

Tags: IRS, Health Insurance, DOMA FSA HSA

2014 IRS Cost of Living Adjustments

Posted by Nathan Carlson on Friday, November 01, 2013 @ 01:30 PM

Tags: Pension, 401(k). SIMPLE IRA, ERISA, Retirement Planning

Why A $Million is Not Enough for Retirement!

Posted by Nathan Carlson on Tuesday, October 22, 2013 @ 03:19 PM

For many, retiring with a million dollars would be a dream come true. However, for a highly paid professional, a million dollar retirement nest egg may only be a third or fourth of what is actually needed. Numerous studies have shown that key to a successful retirement is the management of the annual withdrawal rate. Industry professionals recommend withdrawing no more than five percent of your retirement savings in any year. Therefore, a million dollar retirement nest egg will only provide a $50,000 annual retirement income, two million would provide an annual retirement income of $100,000, and so on. Essentially, one takes the desired annual retirement income and divides that number by 5% (.05).

Tags: Pension, Retirement Planning, 401(k)

The ONLY True Fix to our Healthcare System-Part 2

Posted by Nathan Carlson on Thursday, October 03, 2013 @ 02:40 PM

Using the Lessons from LASIK, (that I discussed in Part 1) the existing medical system must be redesigned so that it fosters competition, enables consumerism, empowers capitalism, and engenders compassion.

The ONLY True Fix to our Healthcare System-Part 1

Posted by Nathan Carlson on Tuesday, September 24, 2013 @ 04:54 PM

At a time when medical expenses have been rising at twice the rate of inflation, one major medical procedure today costs ten percent of what it cost 10 years ago. Also, today this

procedure is far better, far safer, life changing, and millions have received this marvelous treatment.

DOL Audits and Criminal Investigations are Increasing

Posted by Nathan Carlson on Wednesday, September 04, 2013 @ 03:20 PM

When ERISA was passed in 1974, Congress realized that the provisions of ERISA would have to

be enforced. So, Congress also created the Employee Benefits Security Administration (EBSA), which is responsible for ensuring the compliance and integrity of the private employee benefit system in the United States. EBSA is a division of the Department of Labor.