As consumer-driven benefits continue to rise in the market, so the options for benefit administrators continue to expand for employers. Carriers, banks, HR software companies—it seems that more and more providers are adding FSA and HSA administration to their list of services. With so many choices, it can be difficult to decide who to trust with your pre-tax benefits, but in this dynamic, complex benefit world, it’s more important than ever to have a provider that offers stability, compliance expertise, security, and personalization.

Unbundled: Why an Independent Benefit Administrator is the Best Choice for Your Pre-Tax Accounts

Posted by Lindsay Barnard on Wednesday, July 25, 2018 @ 03:45 PM

Tags: Compliance, FSA, HSA, TPA, Benefit Administration, benefits, third party administrator, hra

Filing Your 2017 Tax Return? Here are our HSA tips and tricks.

Posted by Lindsay Barnard on Wednesday, February 28, 2018 @ 05:42 PM

Tax season is here! As we get closer to the deadline for filing (in 2018, it’s April 17 instead of the traditional April 15), we wanted to share three tips about Health Savings Accounts you’ll need to know before you file your return, along with a suggestion for using your refund.

Tags: Compliance, Benefits Information, Health Care, Healthcare, HSA, HDHP, TPA, Benefit Administration, savings, third party administrator, brokers, Health Savings Accounts, tax return, taxes

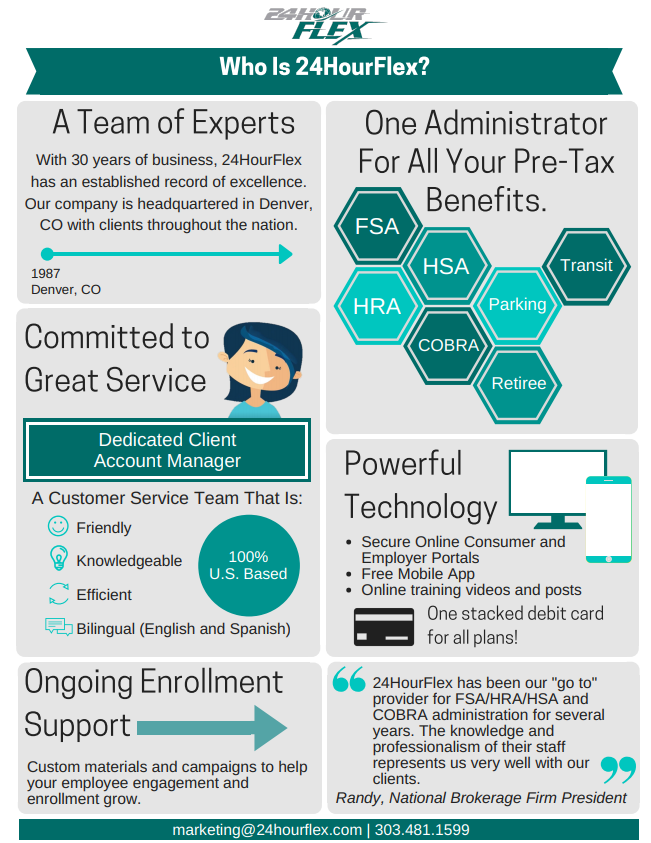

Who is 24HourFlex? [Infographic]

Posted by Lindsay Barnard on Wednesday, January 17, 2018 @ 08:37 AM

Knowing who you work with -- and providing your clients the resources to choose who they work with -- is important. But in the increasingly complex healthcare industry, it can be a challenge to juggle information from so many partners and vendors.

Tags: Cafeteria Plans, COBRA, COBRA Administration, Compliance, Colorado, FSA, HSA, TPA, Benefit Administration, employees, benefits, employers, third party administrator, brokers, Health Savings Accounts, Infographic

Terminating a SIMPLE Can Be Simple, if Done Right

Posted by Nathan Carlson on Monday, October 27, 2014 @ 01:56 PM

There are many different forms of qualified retirement plans--among them, 401(k), profit sharing,

defined benefit, ESOPs, 403(b), SIMPLE IRAs, and SIMPLE 401(k) plans. One of the unique requirements of SIMPLE IRAs and SIMPLE 401(k) plans is that they must be the sole, exclusive plan of the employer for the entire calendar year. In other words, an employer sponsoring a SIMPLE IRA or SIMPLE 401(k) cannot, in the same calendar year, also sponsor a regular 401(k) plan or any other qualified retirement plan.

Tags: 401(k), SIMPLE IRA, Compliance