HSA vs 401(k)

If your company has decided to offer a high deductible health plan, don’t worry, you are not alone. Recent studies show that an increasing number of employers have elected to offer high deductible health plans (HDHP) either to completely replace or be offered in conjunction with a more traditional Preferred Provider Organization (PPO) plan or Health Maintenance Organization (HMO) plan. When sponsoring a HDHP, employers typically offer their employees the ability to contribute to a Health Savings Account (HSA) to help offset the increased deductible associated with the HDHP. In 2017, 19 percent of all workers were enrolled in

a HDHP

with a HSA savings option. This is a dramatic rise since 2007 when just over 4 percent were covered under such plans.

Read More

Tags:

Retirement Planning,

IRS,

401(k),

Healthcare,

HSA,

TPA,

tax savings,

financial planning

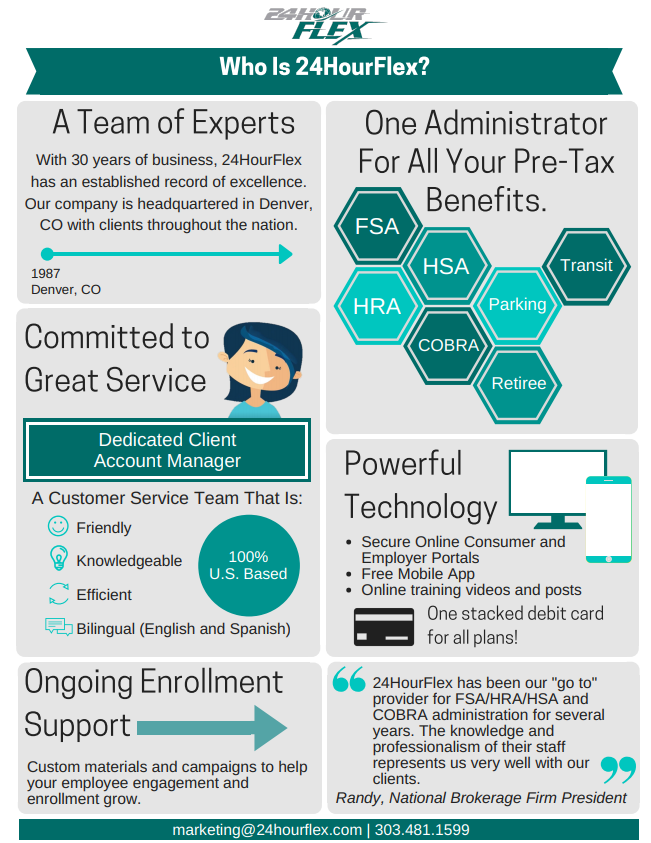

As consumer-driven benefits continue to rise in the market, so the options for benefit administrators continue to expand for employers. Carriers, banks, HR software companies—it seems that more and more providers are adding FSA and HSA administration to their list of services. With so many choices, it can be difficult to decide who to trust with your pre-tax benefits, but in this dynamic, complex benefit world, it’s more important than ever to have a provider that offers stability, compliance expertise, security, and personalization.

Read More

Tags:

Compliance,

FSA,

HSA,

TPA,

Benefit Administration,

benefits,

third party administrator,

hra

Tax season is here! As we get closer to the deadline for filing (in 2018, it’s April 17 instead of the traditional April 15), we wanted to share three tips about Health Savings Accounts you’ll need to know before you file your return, along with a suggestion for using your refund.

Read More

Tags:

Compliance,

Benefits Information,

Health Care,

Healthcare,

HSA,

HDHP,

TPA,

Benefit Administration,

savings,

third party administrator,

brokers,

Health Savings Accounts,

tax return,

taxes

Knowing who you work with -- and providing your clients the resources to choose who they work with -- is important. But in the increasingly complex healthcare industry, it can be a challenge to juggle information from so many partners and vendors.

Read More

Tags:

Cafeteria Plans,

COBRA,

COBRA Administration,

Compliance,

Colorado,

FSA,

HSA,

TPA,

Benefit Administration,

employees,

benefits,

employers,

third party administrator,

brokers,

Health Savings Accounts,

Infographic

Open enrollment is only a couple months away, and planning may be beginning now for 2018. As companies look to contain health care costs, more and more are considering a high deductible health plan (HDHP) with a health savings account (HSA) in addition to a traditional health plan or possibly in place of a traditional plan. Either case requires a new level of education and support to get everyone’s understanding of the value of this type of product.

Read More

Tags:

Healthcare,

HSA,

HDHP,

TPA,

Benefit Administration