If you or your client is one of the thousands of business owners that have a SIMPLE IRA retirement plan, then you may want to reconsider the options. Below are 3 reasons a 401(k) is better than a SIMPLE (Savings Incentive Match Plan for Employers) IRA.

A 401(k) is a better plan to help PREPARE FOR RETIREMENT.

Can saving $12,000 a year prepare you for retirement? If the answer is yes, than a SIMPLE may be the plan for you. Most likely, however, the answer is no. With a 401(k) plan, a participant can:

I. Defer more money

A SIMPLE only allows an eligible participant to contribute a max of $12,000 (and an additional $2,500 catch-up contribution if 50 or older) per year. With a 401(k) plan, however, an eligible participant can contribute up to $17,500 (and an additional $5,500 catch-up contribution if 50 or older) per year.

II. Save more money with profit sharing and/or matching contributions

In a SIMPLE, the employer is required to make a contribution to the plan and can choose one of only two options:

- make a non-elective contribution of 2% of compensation for all eligible employees earning $5,000 or more; OR

- make a matching contribution of 100% of the first 3% of compensation.

In a 401(k) plan, there is no obligation for employer contributions. There are, however, a multitude of plan designs that can be considered to maximize contributions for owners and/or key employees. These designs are subject to nondiscrimination testing, but in many cases, owners can contribute an additional profit sharing contribution of $33,500 into their own retirement savings, or a total contribution (including personal deferrals) of $51,000, or $56,500 including catch-up. The differences in these numbers are staggering, especially when you consider the increase in contribution amounts over time.

TAX SAVINGS are better with a 401(k).

Typically, costs are the main reason business owners consider, and may be persuaded to adopt a SIMPLE. Because there are no filing or testing requirements, there are usually little to no administrative costs. I also want to point out that the employer funding to a Safe Harbor 401(k) plan is only about 1% more than the required funding to a SIMPLE IRA. So, for only a small, marginal increase in employer funding, business owners and other participants can defer between $5,500 and $8,500 more with a 401(k) and save significantly more on taxes.

At a marginal federal and state tax bracket of 40%, these additional contributions in a 401(k) will create an increased tax savings between $2,200 and $3,400 per participant (40% x $5,500 or 40% x $8,500).

Any additional employer contributions are also receiving a corporate tax benefit. Once the tax savings are considered, the added costs of a 401(k) often become a moot point.

Flexibility in Plan Design

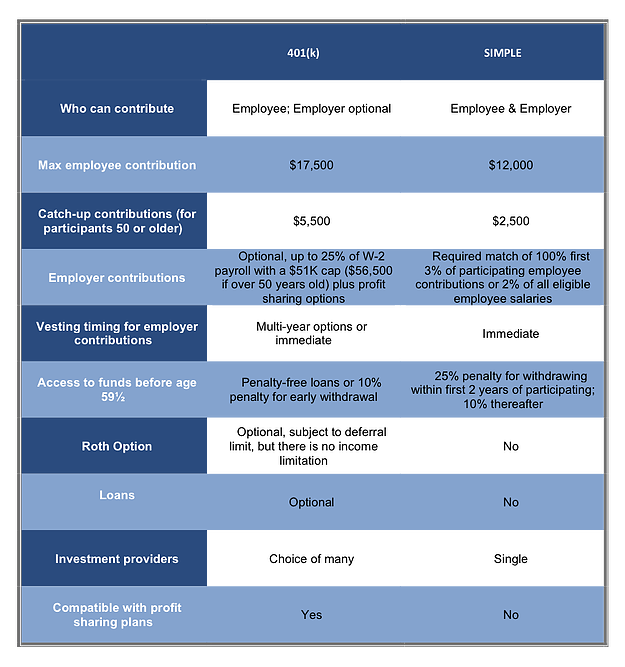

Henry Ford once said "Any customer can have a car painted any colour that he wants, so long as it is black." With a SIMPLE, it's very similar; the structure of the plan design is very limited. 401(k) plans provide options such as loan provisions, Roth, eligibility options and vesting features, but the SIMPLE IRA offers no flexibility. Below is a basic comparison chart to illustrate some of the key differences:

One common misconception with a 401(k) plan is that all eligible employees must receive the same profit sharing percentage. This type of design (known as a pro rata allocation) is certainly one option, but there are many others...and depending upon the demographic information of the plan, some designs can disproportionately favor owners and/or key employees.

SIMPLE IRA’s are becoming less common as the costs for small business 401(k)’s have significantly dropped. Usually, once you future value the SIMPLE IRA contribution amounts, the projected balance at the age of 65 will be terribly insufficient. Employees, and most certainly business owners will need more retirement funding, something that is only available through a 401(k) plan.