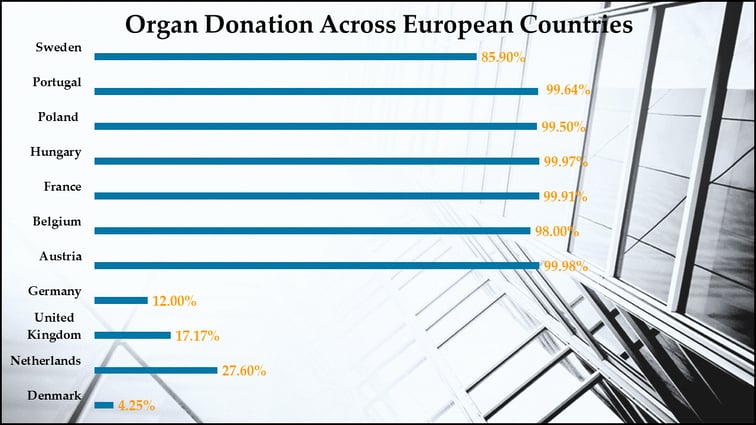

The percentage of individuals in Europe that donate their organs upon their death varies greatly from one European country to the next. For example, only twelve percent of the German citizens choose to donate their organs but if one steps across the border and enters Austria, close to one hundred percent (99.98%) donate their organs. In Denmark only 4.25% donate their organs, but if one leaves Copenhagen and drives across the Oresund Bridge, down the two-mile long undersea Drogden Tunnel and into Sweden, 86% of the population donate their organs. Why these strange differences amongst very similar demographics?

Germany, United Kingdom, Netherlands, and Denmark all require an explicit consent before organs can be donated whereas the other seven countries in the study presume that consent has been given unless the citizen specifically opts out of the organ donation program.[1]

In a traditional 401(k) or 403(b) plan at least 30% of the employees never get around to enrolling in the plan, whether or not there is an employer match. However, when eligible employees are automatically enrolled in the plan (consent is presumed) and then given the option to opt out, about 91% stay enrolled in the retirement plan.[2]

Yes, organ donation rates can teach us about human tendencies and retirement plans. For further information about adding Auto-Enrollment provisions or to visit with an ERISA professional at Retirement Planning Services, click on the button below.

Have any questions?

[1] Max Bazeman, Psychology of Negotiations, Harvard Business School, 2014

[2] Auto-enroll provisions can only be added to an existing 401(k) or 403(b) plan at certain times during the plan year and only with the necessary plan document amendments and employee notices. Such provisions must be installed by a competent ERISA professional.