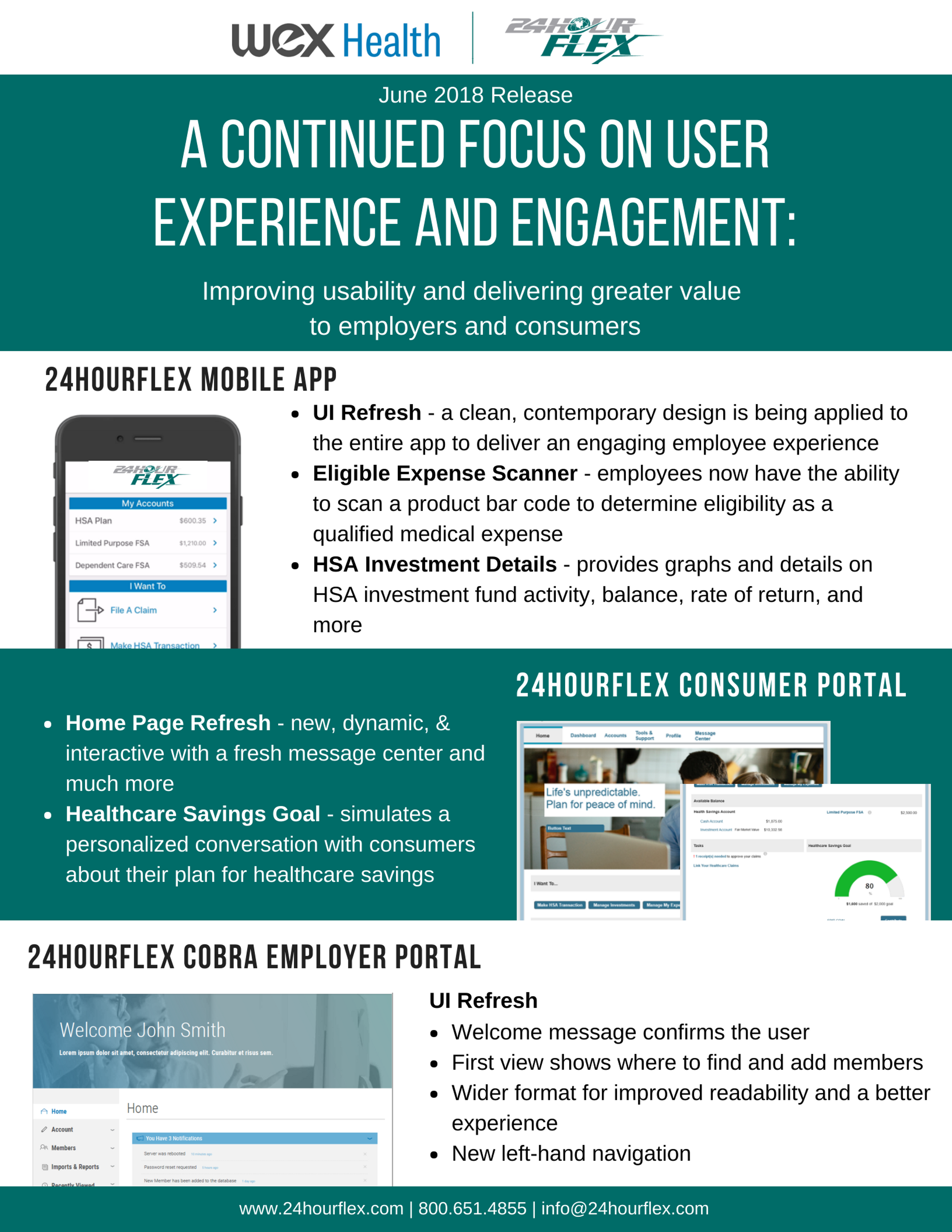

At 24HourFlex, we are always looking for ways to make your day better and simplify your life. That's why we partner with WEX Health to bring you to the most powerful and intuitive software to help you manage your benefits.

An Improved User Experience: Software and Design Updates Coming June 2018

Posted by Lindsay Barnard on Thursday, June 07, 2018 @ 09:09 AM

Tags: COBRA, COBRA Administration, COBRA TPA, FSA, HSA, third party administrator, technology, online resources, software, wex health, mobile app

3 Ways to Help Employees Manage Their Healthcare Expenses

Posted by Lindsay Barnard on Wednesday, May 30, 2018 @ 12:09 PM

The United States now spends almost twice as much on healthcare as other advanced industrialized countries, even though just a few decades ago our healthcare spend was closely aligned to that of other countries. As a result of the rising cost of healthcare, changes to employment and benefits laws and the availability of new benefits options, the employee benefits landscape in the U.S. has also been dramatically altered. One in four Americans now report that the cost of healthcare is the biggest concern facing their family, according to a Monmouth University poll. This makes it more important than ever for employers to offer their employees the guidance and tools they need to manage their healthcare plans and costs. Here are three approaches to help employees manage their healthcare expenses:

Tags: FSA, Healthcare, HSA, HDHP, employees, employers, Employee Engagement, cdhp, consumer, hra, tax savings

Legislative Update: IRS Revises HSA Family Contribution Limit for 2018

Posted by Lindsay Barnard on Wednesday, March 07, 2018 @ 09:25 AM

On Monday, the IRS released Bulletin 2018-10, which included a revision to the 2018 Family contribution limit for Health Savings Accounts (HSA).

Tags: IRS, HSA, employers, Health Savings Accounts, Education, tax return, taxes, contribution, contribution limits, legislative updates, irs bulletin, legislation

Filing Your 2017 Tax Return? Here are our HSA tips and tricks.

Posted by Lindsay Barnard on Wednesday, February 28, 2018 @ 05:42 PM

Tax season is here! As we get closer to the deadline for filing (in 2018, it’s April 17 instead of the traditional April 15), we wanted to share three tips about Health Savings Accounts you’ll need to know before you file your return, along with a suggestion for using your refund.

Tags: Compliance, Benefits Information, Health Care, Healthcare, HSA, HDHP, TPA, Benefit Administration, savings, third party administrator, brokers, Health Savings Accounts, tax return, taxes

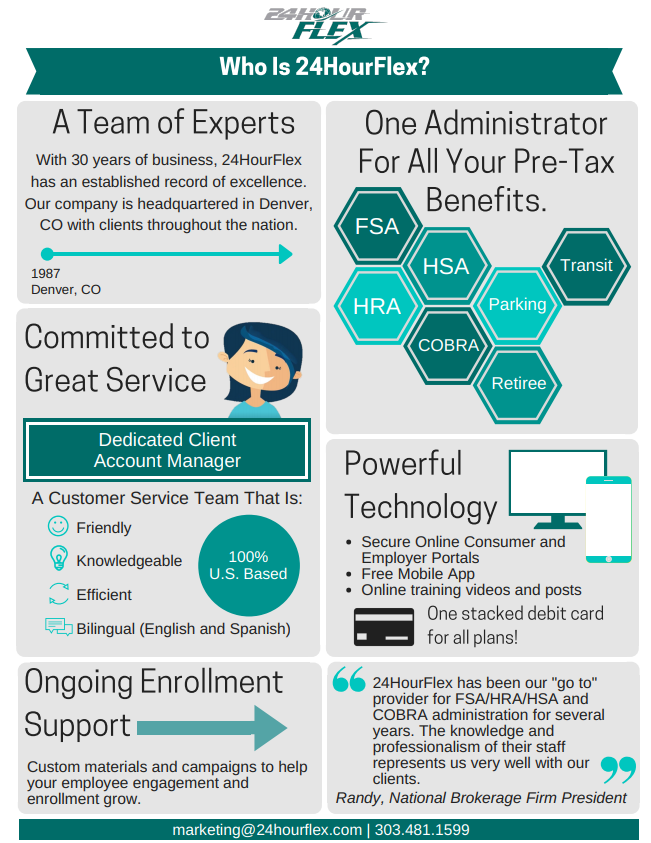

Who is 24HourFlex? [Infographic]

Posted by Lindsay Barnard on Wednesday, January 17, 2018 @ 08:37 AM

Knowing who you work with -- and providing your clients the resources to choose who they work with -- is important. But in the increasingly complex healthcare industry, it can be a challenge to juggle information from so many partners and vendors.

Tags: Cafeteria Plans, COBRA, COBRA Administration, Compliance, Colorado, FSA, HSA, TPA, Benefit Administration, employees, benefits, employers, third party administrator, brokers, Health Savings Accounts, Infographic

Video Spotlight: What is a Health Savings Account?

Posted by Lindsay Barnard on Tuesday, August 08, 2017 @ 03:34 PM

One of the biggest barriers to increasing employee engagement with and enrollment in pre-tax benefits is simply a lack of education. At 24HourFlex, it is one of our priorities to make sure that employers are equipped with the tools they need to inform their employees about their benefits with high-quality, accessible content.

Tags: HSA, Video, Health Savings Accounts, Education, Employee Engagement

Savings: The Most Overlooked Word in Health Savings Account

Posted by Lindsay Barnard on Thursday, July 20, 2017 @ 12:24 PM

It comes as no surprise that many Americans are concerned about retirement. Diligently putting money into 401(k) or any other form of retirement savings account, many still miss one key ingredient that could offer not only tax benefits, but sustainable growth well into retirement.

Tags: Retirement Planning, 401(k), HSA, Benefit Administration, employees, retirement, savings, benefits, employers, third party administrator, brokers

An HDHP with an HSA Can Work for You

Posted by Lindsay Barnard on Wednesday, July 12, 2017 @ 02:08 PM

Open enrollment is only a couple months away, and planning may be beginning now for 2018. As companies look to contain health care costs, more and more are considering a high deductible health plan (HDHP) with a health savings account (HSA) in addition to a traditional health plan or possibly in place of a traditional plan. Either case requires a new level of education and support to get everyone’s understanding of the value of this type of product.

Tags: Healthcare, HSA, HDHP, TPA, Benefit Administration

IRS Increases FSA Limit to $2,600 in 2017

Posted by Jim Hayes on Tuesday, October 25, 2016 @ 09:26 PM

The IRS Increases Medical FSA Limit to $2,600:

The IRS announced today (10/25/2016) that the Medical FSA and Limited Purpose FSA cap will increase to $2,600 (an increase $50) for plan years beginning on or after January 1st, 2017. If your plan document was created by 24HourFlex the language will reference the maximum amount permitted, in which case no change is required.

Keep reading below for commonly asked questions related to this update.

The New Healthcare Cadillac Tax - Why it Matters to YOU

Posted by Nathan Carlson on Thursday, December 03, 2015 @ 09:05 AM

Your employer may soon have to cut back on the healthcare benefits provided to you to avoid an onerous 40% federal tax called the “Cadillac Tax”. Starting in 2018, companies that are too generous to their employees by providing attractive healthcare insurance will be hit with a huge tax. The Kaiser Family Foundation, a respected, nonprofit research group, estimates that one in four companies will be affected by this tax, and to avoid it, will have to cut back on their healthcare benefits.

To add insult to injury, the law says that starting in 2018, any pretax amount YOU put into your own Medical Flexible Spending Account or Health Savings Account has to be counted as employer-provided healthcare benefits and could trigger this 40% Cadillac tax. Yes, you read that correctly. Such contributions count as EMPLOYER contributions when calculating this tax, which means that starting in 2018 when you make these pretax payroll contributions to your own Medical Flexible Spending Account or your own Health Savings Account (HSA), your employer may have to cut back even further on the healthcare benefits provided to you if this onerous 40% tax is to be avoided.

As our Congressmen and Senators are becoming aware of the unfair nature of this tax, a bipartisan coalition is forming to change the law. This provision of Healthcare reform is so bad that even Labor Unions and Republicans have joined together to amend this portion of the Act. Politics makes for strange bedfellows at times.

Isn’t 2018 a long way off? Why do I care now?

In anticipation of this upcoming “Cadillac” tax, companies are already cutting back on their healthcare benefit packages by only offering healthcare insurance with larger deductibles, knowing that big changes to benefits packages cannot be done in just one year.

What Can You Do?

24HourFlex has joined forces with ECFC, the Employer’s Council for Flexible Compensation, to change the law. Ideally, we would like the “Cadillac” Tax provisions repealed entirely. At this time that may not be realistic. However, at a minimum we want the law changed so that YOUR pretax contributions to YOUR Medical Flexible Spending Account or YOUR Health Savings Account are NOT counted as EMPLOYER contributions when calculating this tax.

Tags: IRS, Health Care