The IRS announced on January 23, 2014 that Cash Balance defined benefit plans will eventually be able to utilize pre-approved master and prototype plan documents. Currently, all Cash Balance plans must be written as individually-designed documents. The IRS announcement extends to February 2, 2015 the deadline for plan document drafters to submit their new traditional defined benefit master and prototype plan documents for IRS approval. By extending that deadline from January 31, 2014, the IRS stated it will now have time to publish guidance on Cash Balance plan language that will eventually be acceptable under the IRS’s master and prototype program.

Important Development for Cash Balance Plans—But You Must Act Quickly!

Posted by Nathan Carlson on Wednesday, January 29, 2014 @ 02:49 PM

Tags: Pension

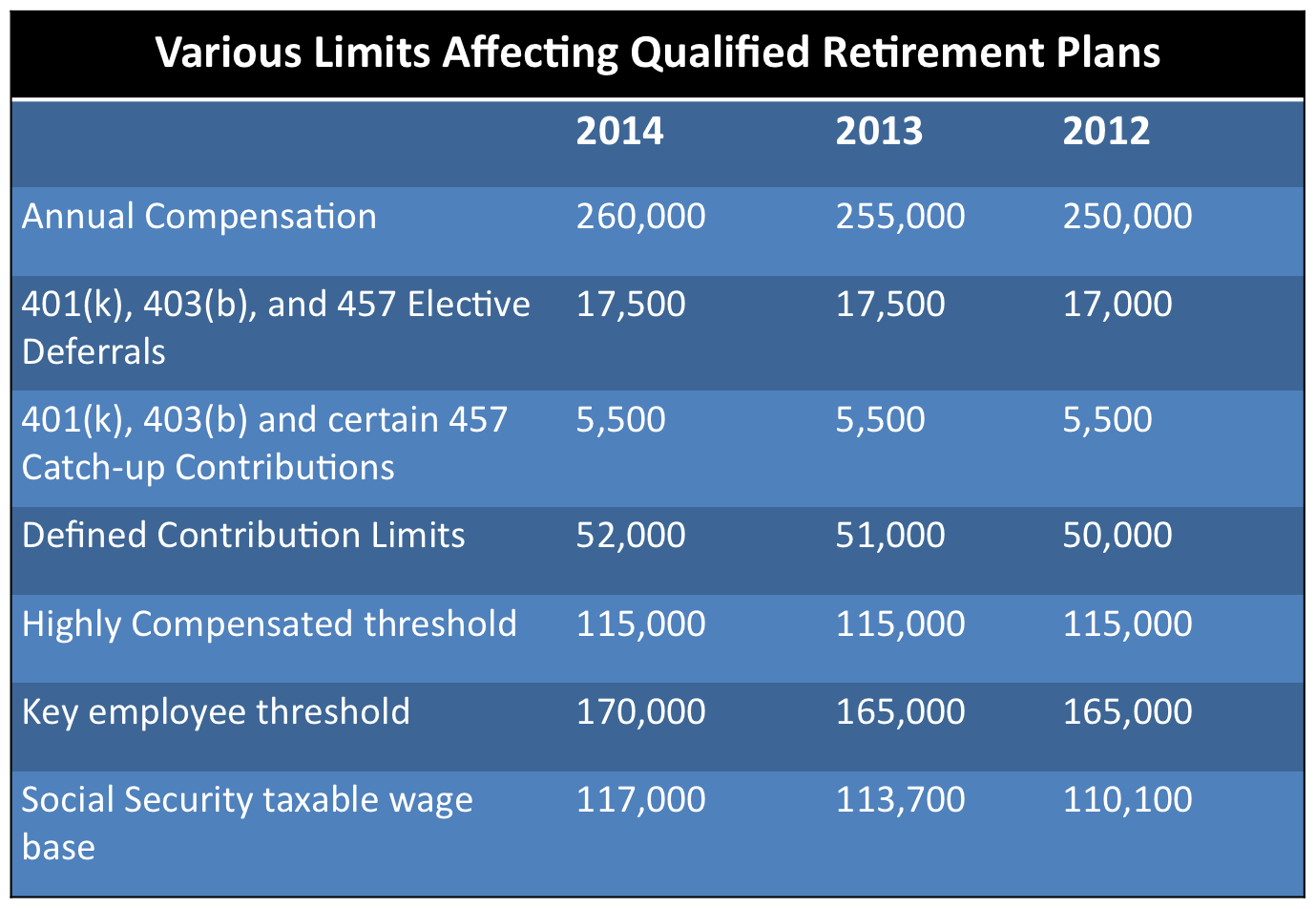

2014 IRS Cost of Living Adjustments

Posted by Nathan Carlson on Friday, November 01, 2013 @ 01:30 PM

Tags: Pension, 401(k). SIMPLE IRA, ERISA, Retirement Planning

Why A $Million is Not Enough for Retirement!

Posted by Nathan Carlson on Tuesday, October 22, 2013 @ 03:19 PM

For many, retiring with a million dollars would be a dream come true. However, for a highly paid professional, a million dollar retirement nest egg may only be a third or fourth of what is actually needed. Numerous studies have shown that key to a successful retirement is the management of the annual withdrawal rate. Industry professionals recommend withdrawing no more than five percent of your retirement savings in any year. Therefore, a million dollar retirement nest egg will only provide a $50,000 annual retirement income, two million would provide an annual retirement income of $100,000, and so on. Essentially, one takes the desired annual retirement income and divides that number by 5% (.05).

Tags: Pension, Retirement Planning, 401(k)

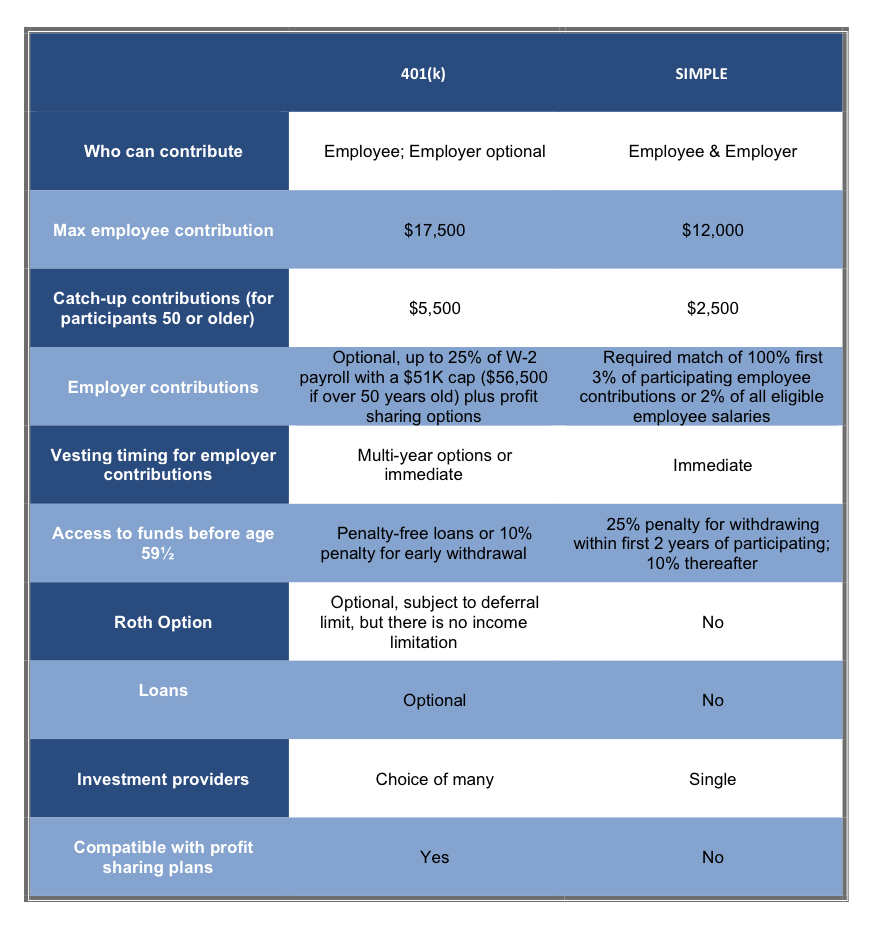

3 Reasons a 401(K) Plan Is Better Than a SIMPLE IRA

Posted by Sean Kadel on Thursday, October 10, 2013 @ 05:22 PM

If you or your client is one of the thousands of business owners that have a SIMPLE IRA retirement plan, then you may want to reconsider the options. Below are 3 reasons a 401(k) is better than a SIMPLE (Savings Incentive Match Plan for Employers) IRA.

Tags: Pension, 401(k). SIMPLE IRA

Is a Cash Balance Plan the Right Fit for My Company? (Part 2)

Posted by Brooke Cozort on Tuesday, September 10, 2013 @ 04:13 PM

Now that you know what a Cash Balance Plan is from reading Part 1 Is a Cash Balance Plan Right For My Company? Part 1 of this series, the next step is: What are the reasons for setting up a Cash Balance Plan?

DOL Audits and Criminal Investigations are Increasing

Posted by Nathan Carlson on Wednesday, September 04, 2013 @ 03:20 PM

When ERISA was passed in 1974, Congress realized that the provisions of ERISA would have to

be enforced. So, Congress also created the Employee Benefits Security Administration (EBSA), which is responsible for ensuring the compliance and integrity of the private employee benefit system in the United States. EBSA is a division of the Department of Labor.

In-Plan ROTH Conversions Available, But Is Your Custodian Ready?

Posted by Brooke Cozort on Tuesday, May 28, 2013 @ 09:32 AM

The In-Plan ROTH Conversions, while attractive to some, will be quite an administrative nightmare. As a Third Party Administrator, I have not had a lot of requests to amend our plans to allow for the “new” In-Plan ROTH Conversions since they became available as a transfer instead of a rollover. This “new” law was effective January 1, 2013 to allow participants in a 401(k), 403(b) or 457 plans to convert ANY of their pre-tax funds to ROTH. Previously, conversions were only allowed if a participant had a distributable event.

Tags: Pension, 401(k), In-Plan Roth Conversions